Introduction

In an era where financial decisions are increasingly complex and significant, having access to the right tools can make all the difference. One such tool that has become indispensable in the world of personal and business finance is the loan calculator. These digital marvels provide users with invaluable insights into loan options, repayment schedules, and financial obligations. At the forefront of Loan calculator development stands JMS Web Solutions, revolutionizing the way individuals and businesses navigate the intricacies of borrowing.

Understanding the Importance of Loan Calculators

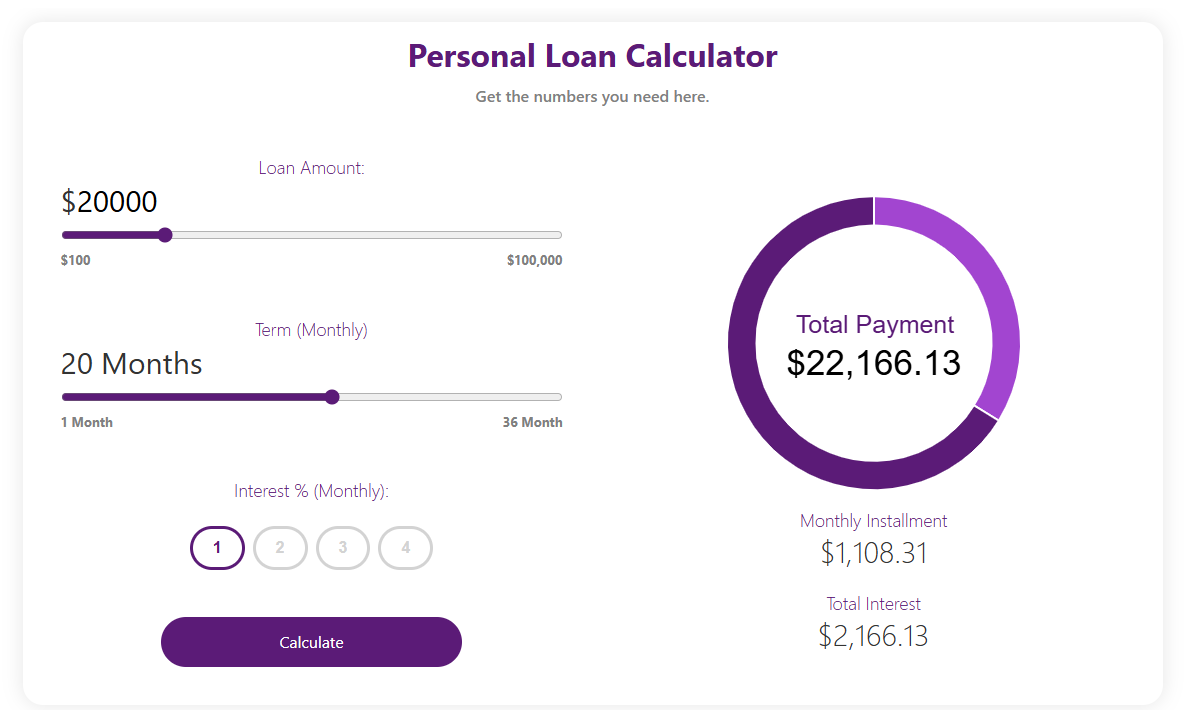

Loan calculators serve a crucial role in empowering individuals and businesses to make informed financial decisions. Loan calculators offer clarity and confidence for mortgage, personal loan, or business financing decisions. Users input loan details to receive accurate payment projections, interest costs, and repayment schedules. This level of transparency enables users to assess affordability, compare different loan options, and plan their finances effectively.

The Evolution of Loan Calculator Development

Loan calculator development has evolved with technology advancements and increased demand for user-friendly financial tools. Initially, loan calculators were simple spreadsheet-based tools with limited functionality. With the internet’s spread and the rise of web apps, loan calculators are now more sophisticated and accessible. Today, users can access loan calculators through websites, mobile apps, and even integrated tools on financial platforms.

JMS Web Solutions: Leading the Way in Loan Calculator Development

At JMS Web Solutions, we understand the importance of harnessing technology for financial clarity. Our experienced developers specialize in crafting custom loan calculators tailored to client and user needs. Whether for mortgages or business loans, we prioritize precision, performance, and user experience for unmatched solutions.

Our Approach to Loan Calculator Development

- Customization: We work closely with our clients to understand their specific requirements and objectives. Whether it’s integrating additional features, customizing the user interface, or incorporating branding elements, we ensure that our loan calculators align with our client’s vision and goals.

- User Experience: We prioritize user experience in our development process. Our loan calculators feature intuitive interfaces, clear instructions, and interactive elements to ensure a seamless user experience. We understand that usability is key to adoption, and we strive to make our calculators accessible to users of all backgrounds and skill levels.

- Accuracy: Accuracy is non-negotiable when it comes to loan calculations. Our team meticulously designs and tests our calculators to ensure that calculations are precise and reliable. Whether it’s accounting for compounding interest, amortization schedules, or variable interest rates, we leave no stone unturned in ensuring the accuracy of our calculations.

- Security: We take data security seriously. Our loan calculators are built with robust encryption and data protection measures to safeguard users’ personal and financial information. We adhere to industry best practices and compliance standards to ensure the confidentiality and integrity of user data.

Conclusion In

conclusion, loan calculators play a vital role in providing users with the clarity and confidence they need to make informed financial decisions. At JMS Web Solutions, we are committed to harnessing technology for financial clarity through our innovative loan calculator development services. With our focus on customization, user experience, accuracy, and security, we empower individuals and businesses to navigate the complexities of borrowing with ease. Contact us today to learn more about our loan calculator development services and take the first step toward financial clarity.